20

|

Reach

Issue 8 2015

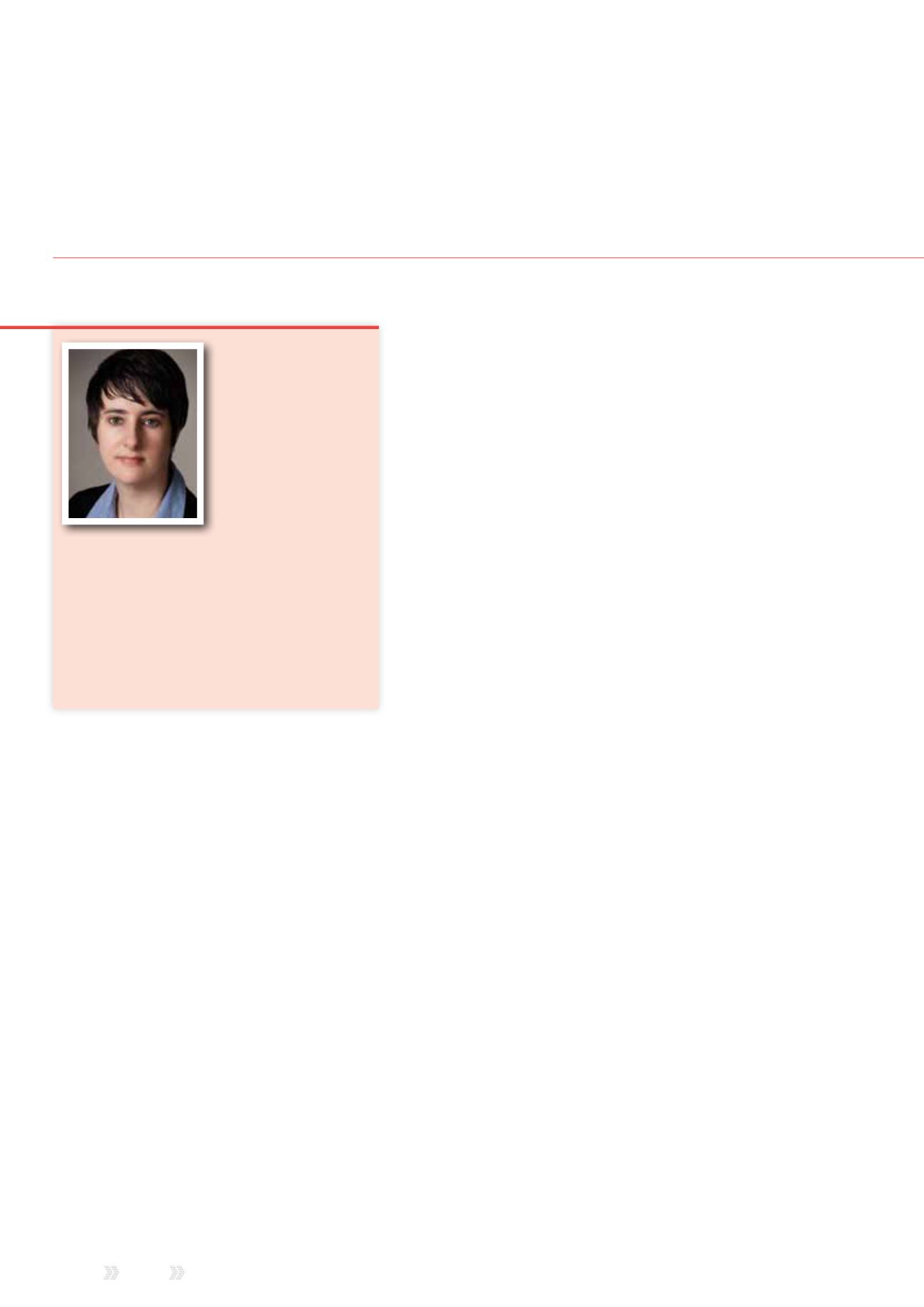

Sheridan Nye,

Senior Research

Analyst,

Information &

Communication

Technologies,

Frost & Sullivan

Sheridan Nye is a Senior

Analyst at Frost & Sullivan

and has more than 15

years experience as

a market analyst and journalist in the field of global

telecommunications, based in London and the

US. Sheridan produces reports, in-depth analysis

and presentations for high-level clients at telecom

service providers and technology vendors. Sheridan’s

specialities include communications industry market

analysis, forecasting, bespoke research and consulting

as well as ICT in vertical industries.

C

ritical communications

users are long overdue

the benefits of mobile

broadband data. Consumers

enjoy streaming video ‘anytime,

anywhere’ on their smartphones,

but public safety, utilities and

transportation have missed out

on many of the latest technology

advances.

Employees in non-mission-critical

roles can turn to their personal

phones for convenient access

to email, maps and other basic

services. Bring Your Own Device

(BYOD) is encouraged in many

companies. But it’s far from ideal

in hostile environments, given the

flimsy construction and security

vulnerabilities of products designed

for consumers.

This frustrating situation is now

beginning to change. The gradual

roll out of long term evolution (LTE)

networks around the world is one

reason, though insufficient on its

own. Equally important is the diverse

range of market participants who

are committed to bring the benefits

of data to the sector. Network

operators, vendors and applications

developers are devising profitable

business models, while regulators

and standards-makers need to play

their part to remove barriers and

stimulate the market.

No one says the road to truly

mission critical, mobile data is easy.

End users around the world face

many complex decisions, depending

on their sunk investments in

narrowband voice and the availability,

or not, of suitable spectrum. Another

challenge is to budget for parallel

voice and data infrastructure.

Communications technologies tend

to live on for several years beyond

original expectations – witness iDen

in the US, which Sprint kept ticking

over until just last year. With TETRA

deployments still under way, including

nationwide rollouts in Europe, it’s

difficult to anticipate the rate of asset

depreciation or future vendor support.

Europe’s commercial mobile

network operators (MNOs) are

certainly more involved than they

ever have been before – as host

networks for specialist data mobile

virtual network operators (MVNOs)

such as Airwave Smart Mobile or

Belgium’s Blue Light Mobile, or even

potentially as direct providers, as

proposed in the UK. Unfortunately,

the pioneering commitment of the

US to a dedicated, national LTE

network for public safety has so

far veered from one pothole to

another. The $7 billion (£4.16 billion)

project seems stalled by political

in-fighting and MNOs have not

fallen over themselves to make

deals with the FirstNet organisation,

which oversees the project. Though

dedicated 700MHz spectrum is still

in play in Europe, legislators may

take a view that diverse market

solutions can better address each

country’s needs.

Beyond cost benefits

Whichever route individual countries

take, mobile data will have far-

reaching impact across the varied

domain of critical communications.

But end users must be convinced

that the investment in new services

and devices will deliver real benefits.

This means, firstly, the ability to get

the job done more quickly and safely,

and at lower cost. Beyond that, a

host of data-enabled use cases is

set to transform the way that critical

services are delivered.

So what should critical

communications customers expect

from mobile data?

A service doesn’t need tremendous

bandwidth to deliver value quickly. The

ability to file reports and issue citations

from a mobile device reduces the

admin burden and lets a police officer

remain in the field for longer. Similarly,

ambulances can sit at locations where

a combination of data analytics and

local knowledge suggests a medical

emergency could occur – such as

stadiums or major rail stations.

Sharing of GPS location data

across different agencies enables

co-operation and re-use of resources.

Asset tracking is another low-

throughput service that quickly justifies

itself in less lost equipment. Other

services can be targeted at particular

cost concerns – for example, replacing

satellite links to surveillance vans with

3G/ 4G alternatives.

But the biggest impact comes

from adding a ‘digital dimension’ to

situational awareness. Intelligence

gathering from body-worn cameras,

automated tracking of vehicle number

plates, and navigation tools with

augmented reality overlays are just

Mobile broadband: addi

Dimension to Situationa